Maintaining a balance between profitability and compliance can be daunting in the highly regulated financial services industry. Small financial services businesses are subject to various controls by regulators and cyber-insurers, making compliance a critical aspect of their daily operations. At the same time, these businesses must also focus on growing and maintaining their bottom line. This is where managed IT services for financial services come into play, offering a comprehensive and cost-effective solution enabling financial services firms to achieve their compliance and profitability goals.

RMM for Patching, Monitoring, and Management

One of the cornerstones of a well-managed IT infrastructure is staying up-to-date with software patches and updates. Remote monitoring and management platforms automate this critical process, ensuring your systems are always patched, monitored, and managed. By deploying RMM, MTG can help small financial services businesses significantly reduce their exposure to potential security vulnerabilities, minimize the risk of data breaches, and maintain compliance with regulations.

Sophos Intercept-X and MDR for Advanced Threat Protection

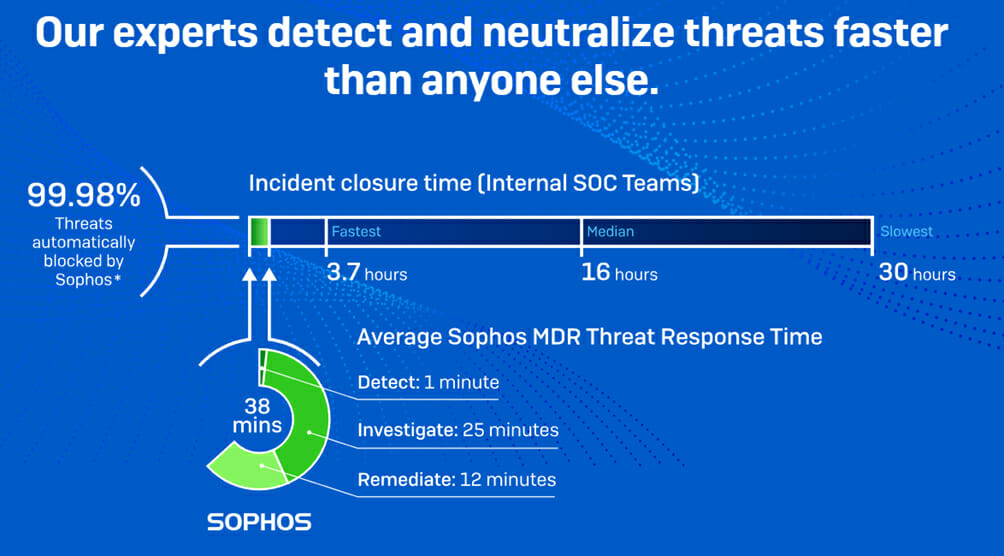

As cyber threats evolve and become more sophisticated, financial services firms must proactively protect their sensitive data and comply with regulatory requirements.

Sophos Intercept-X and Managed Detection and Response (MDR) provide advanced threat protection by leveraging artificial intelligence and machine learning to detect and neutralize malware, ransomware, and other cyber threats. By incorporating Sophos Intercept-X and MDR into your IT security strategy, you can achieve a higher level of protection for your business and ensure regulatory compliance.

24×7 Helpdesk for Support

In the fast-paced world of financial services, issues can arise at any time. Access to a 24×7 helpdesk for support is essential to keeping your business running smoothly. Our dedicated team of experts is always available to address any IT challenges, providing prompt and efficient resolutions. This level of support ensures minimal downtime, allowing your financial services firm to remain productive, competitive, and compliant.

Expertise in Office 365 and Familiarity with Purview Compliance Tools

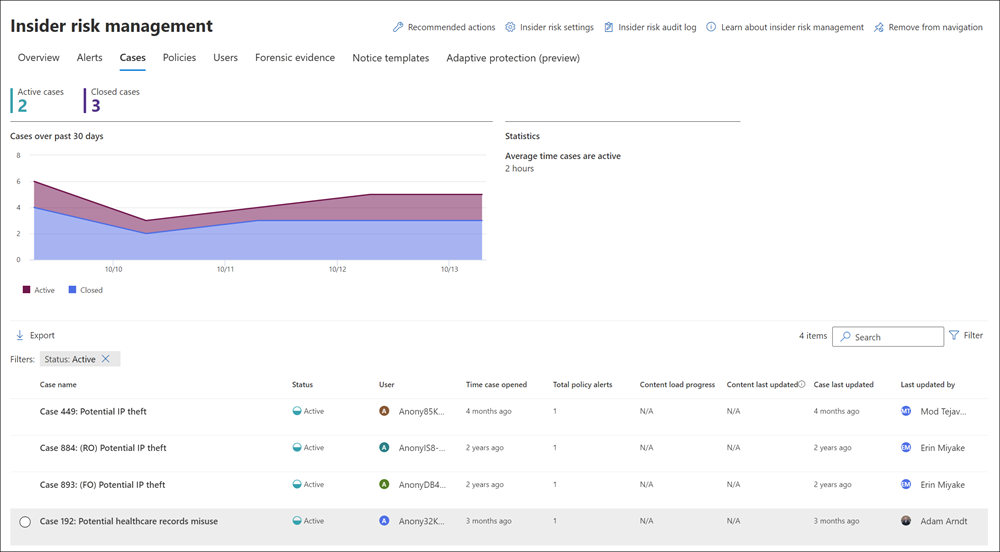

Microsoft Office 365 is a popular choice for many financial services businesses due to its robust suite of productivity tools and cloud-based infrastructure. Our team of experts is well-versed in Office 365 and can help you make the most of its capabilities.

Additionally, we are familiar with Purview, Microsoft’s suite of compliance tools, including eDiscovery, which streamlines the process of searching, locating, and preserving data required for regulatory purposes. By leveraging our expertise in these areas, your business can enhance its operational efficiency and compliance posture.

Security Controls to Ensure Compliance

Implementing strong security controls is paramount for financial services firms seeking to comply with regulations. Our managed IT services include several security measures, such as Sophos Intercept-X for advanced threat protection, multi-factor authentication (MFA) to verify user identities, and automated patching and auditing to ensure your systems are up-to-date and secure. These security controls safeguard your business from potential cyber threats and help you achieve and maintain regulatory compliance.

A Range of Backup Solutions

In the event of data loss or a system failure, having a reliable backup solution is crucial for any financial services business. Our managed IT services offer a range of backup options tailored to your specific needs, ensuring your critical data is always protected and easily recoverable. By implementing a robust backup strategy, you can minimize the impact of data loss incidents on your business operations and maintain compliance with data protection regulations. These include off-site backups, cloud backups and cloud-to-cloud backups (i.e. Office 365)

Conclusion – Managed IT Services

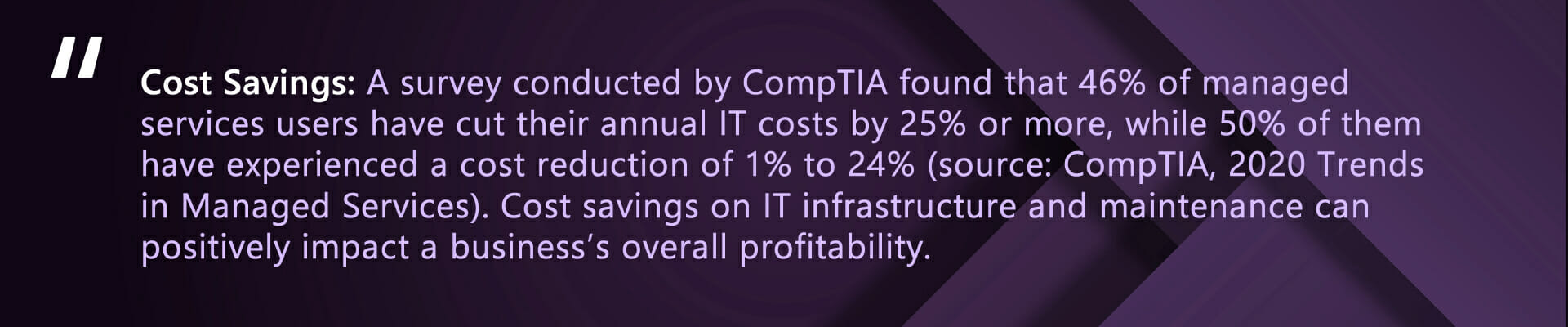

Balancing profitability and compliance in the financial services sector can be challenging, but it becomes much more achievable with the right managed IT services partner. Our comprehensive suite of services, including RMM, Sophos Intercept-X, 24×7 helpdesk support, Office 365 expertise, and robust security controls, enables small financial services businesses to meet their compliance requirements while focusing on growth and profitability.

By partnering with us, you can rest assured that your IT infrastructure is in expert hands, giving you the freedom to concentrate on what truly matters: the success of your business.